Orchyze

The central hub that seamlessly integrates financial operations, connecting lending, compensation, and cross-border transactions into a unified ecosystem.

More Than Just A Money Circuit

Fit your needs with our all-in-one platform.

The central hub that seamlessly integrates financial operations, connecting lending, compensation, and cross-border transactions into a unified ecosystem.

Automates compensation, ensuring accuracy, transparency, and compliance. From payroll to settlements, we handle the complexities so you can focus on what matters.

Enables seamless international transactions with low fees and high-speed processing. Whether sending or receiving money across borders, we make global payments effortless.

Simplifies access to credit with fast, secure, and tailored lending solutions. Whether you need personal or business financing, our platform ensures quick approvals and fair terms.

An international airline processes ticket payments in multiple countries using various payment providers and acquirers.

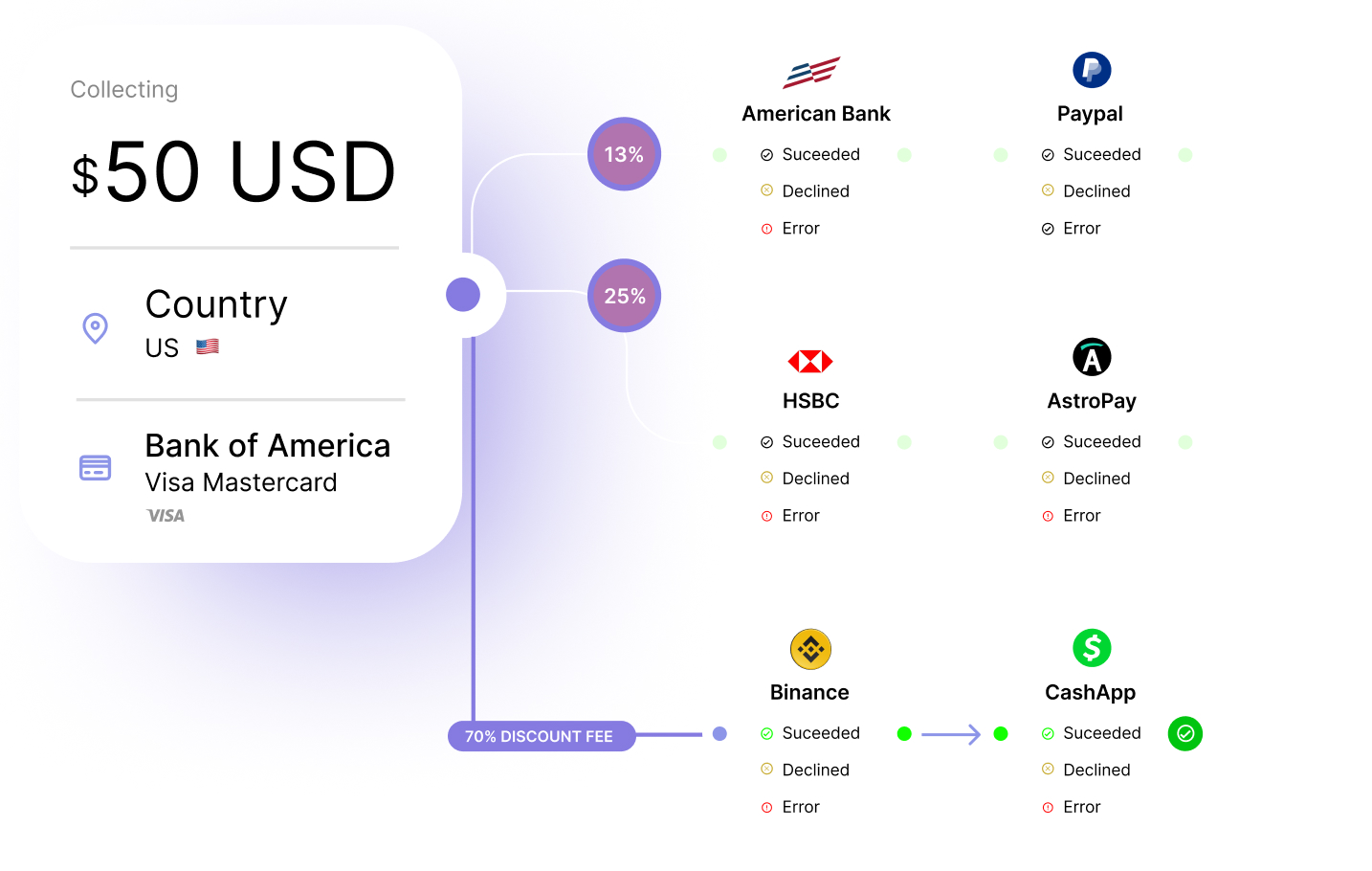

• Smart Routing

Orchyze leverages artificial intelligence to analyze, in real time, the processing fees of different payment providers and acquirers based on the transaction's country and issuing entity. It automatically selects the most cost-effective provider for each transaction, significantly reducing payment processing fees.

• Centralized Reporting

All payment data is consolidated into a single report, providing the airline with a clear overview of revenues, costs, and cash flows across regions. This simplifies financial oversight and supports strategic decision-making.

• Outcome

The airline reduces processing costs, optimizes cash flow, and enhances its global financial management.

Scenario: A Company with global service operates in three regions: United States, Germany, and Brazil, with varying revenue and expense needs across locations.

United States: Surplus of $1,000,000 in subscription revenue.

Germany: Deficit of $200,000 due to local operational costs.

Brazil: Needs $300,000 to fund a regional content licensing agreement.

• Compensaylor - Decision Optimization

Compensaylor analyzes real-time data using AI, including conversion fees, wire fees, and local borrowing rates.

For Germany, it determines that transferring funds from the U.S. via Crosschyze is the most cost-effective option.

For Brazil, it recommends financing through Lendyloan, as local lending offers better rates than transferring funds crossborder.

• Crosschyze - Crossborder Transfer

Executes a $200,000 transfer from the U.S. to Germany. The smart routing feature ensures the transaction uses the lowest fees available.

• Lendyloan - Local Financing

Provides $300,000 in financing to Brazil, ensuring timely funding for the licensing agreement while avoiding high international transfer fees.

Scenario: A global company operates in the U.S., India, and Germany, working with suppliers in multiple countries. Each month, the retailer needs to pay dozens of suppliers in local currencies while keeping operational costs low and ensuring timely payments.

• Supplier Payment Orchestration with Orchyze

The retailer uses Orchyze to automate the dispersion of funds to its suppliers.

The platform selects the most cost-effective payment providers for each supplier based on real-time analysis of fees and processing times, ensuring reduced transaction costs.

• Batch Payments

With Orchyze, the retailer consolidates payments into batches, streamlining the process and reducing administrative workload.

• Crossborder Transfers with Crosschyze

For suppliers in countries without sufficient local funds, Crosschyze facilitates crossborder transfers. Using smart routing, it minimizes conversion fees and transfer costs while ensuring quick settlements.

• Centralized Reporting

All transactions are tracked and reported through a centralized dashboard, giving the retailer complete visibility into its payment processes, helping it identify trends and potential cost-saving opportunities.

Discover the powerful features that make Orchyze the ultimate payment solution.

Simplify payins and payouts, whether local or international.

Operate seamlessly in countries where your business has no local entity.

Streamline financial compensation processes.

Access tailored loans to support your business expansion.

Integrate payment and collection status directly into your administrative system.

Distribute payments quickly and efficiently across locations.

Integrate digital wallets for seamless transactions.

Issue virtual cards for secure and efficient payments.

We reduce transaction costs. ORCHYZE simplifies the integration and management of multiple payment providers and acquirers, optimizing payment processes while significantly reducing transaction costs.

Orchyze acts as an intelligent orchestrator that analyzes a merchant's contracts with banks, acquirers, and payment service providers. Using AI, it automatically selects the most cost-effective channel to process payments based on the payment method (transfers, digital wallets, credit cards, etc.) while considering key data such as the issuing entity, transaction type, and country of issuance. Its goal is to ensure payment, reduce transaction costs, and accelerate processing times.

20M+

Recently Orchestrated

+1000

Active Users

+15 Countries

Recently Unlocked